A major dispute over data security and government regulatory action has emerged on the global stage, as investors in South Korean e-commerce giant Coupang have petitioned the U.S. government to investigate how South Korean authorities handled a massive data breach that affected millions of users, sparking fresh debate about cross-border data governance and the protection of personal information in the digital economy.

In late November 2025, Coupang reported a significant data breach that exposed sensitive personal information of approximately 33 million customers — a striking number that immediately raised alarms among cybersecurity experts and users alike. South Korean authorities responded with multiple investigations and regulatory actions aimed at enforcing local data protection laws and understanding the scope of the breach.

However, this response has now drawn criticism from some of the company’s largest U.S. investors, including Greenoaks Capital and Altimeter Capital. These investment firms filed formal requests urging the United States Trade Representative (USTR) and other relevant agencies to probe whether South Korea’s actions went beyond standard regulatory practice and imposed unfair burdens on Coupang specifically because of its international investor base.

The investors argue that Seoul’s regulatory measures — perceived as overly aggressive — have negatively impacted Coupang’s business operations and its stock market valuation, potentially jeopardising shareholder value and undermining confidence in cross-border investments. These concerns have now escalated beyond corporate boardrooms into the realm of international trade relations, with arbitration claims filed under the U.S.–Korea Free Trade Agreement (KORUS). The filings suggest that trade remedies, including tariffs or sanctions, might be considered if the dispute cannot be resolved through negotiation.

South Korean government officials have denied claims of discriminatory treatment, defending their actions as necessary and justified responses to a breach of such magnitude. President Lee Jae-myung and Trade Minister Yeo Han-koo both reiterated that the government’s regulatory activities aligned with sovereign rights to protect consumer data and enforce national privacy laws. They emphasised that there was no intention to single out any company based on its ownership structure or the nationality of its investors.

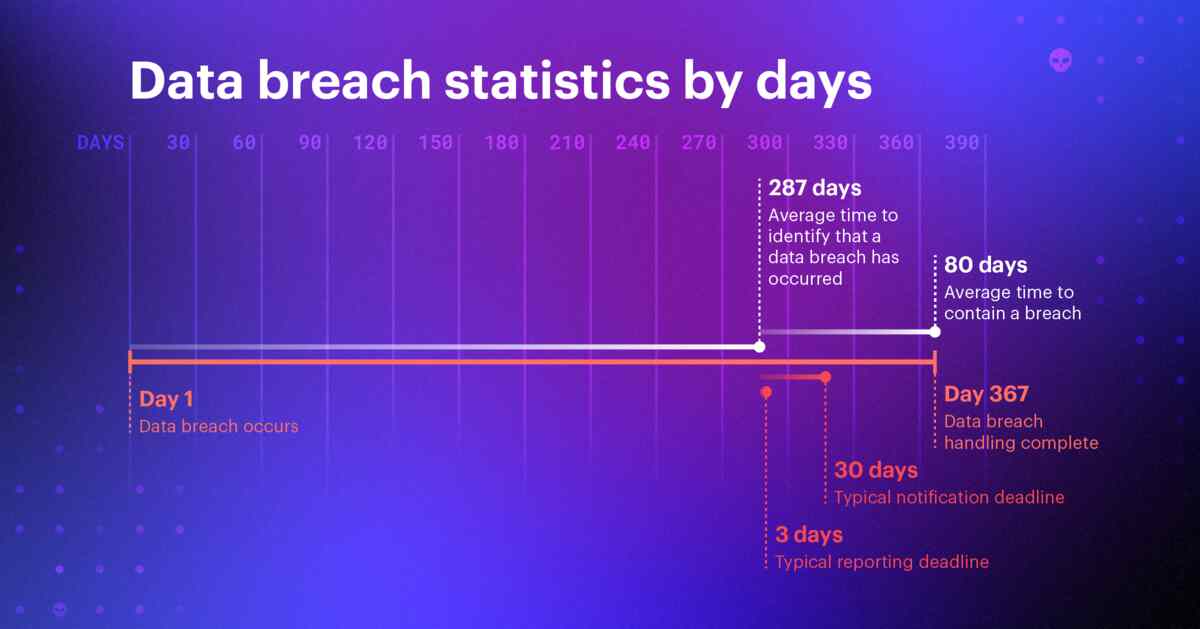

This unfolding story has sparked broader global conversations about how data breaches are regulated and how governments should act when sensitive information is exposed, especially when multinational companies are involved. The Coupang incident is one of several high-profile data breaches in recent years that highlight the growing importance of data security and international cooperation on privacy standards. According to cybersecurity trend reports, data breaches continue to escalate in both frequency and sophistication, with common attack vectors including ransomware, credential theft, and malicious exploitation of system vulnerabilities.

Experts note that global cybersecurity governance is still fragmented, with different regions adopting varying approaches to data protection, enforcement, and incident response. In the U.S., companies have faced their own regulatory and investor scrutiny following major incidents — for example, large amounts of AT&T customer data were exposed in breaches dating back to 2024, leading to class-action lawsuits and consumer backlash.

In Europe and the UK, privacy frameworks like the GDPR have set stringent expectations for breach notification and data handling, influencing regulatory practices worldwide. Meanwhile, industry reports highlight that a lack of unified global standards often leads to disparate and sometimes inconsistent enforcement outcomes, complicating how multinationals manage cybersecurity risk across borders.

In the tech sector, numerous companies are simultaneously facing calls for more rigorous AI risk disclosure and enhanced cybersecurity governance as artificial intelligence becomes deeply integrated into critical systems and data infrastructure. Research shows that many organisations still lack mature AI governance policies, which can exacerbate vulnerabilities and increase the potential impact of breaches when they occur.

The Coupang case also underscores growing scrutiny from investors who are no longer passive stakeholders but active participants in governance and regulatory discourse — especially when large data events intersect with financial performance and reputational risk. It aligns with a broader movement where shareholders increasingly call for transparency, robust privacy practices, and clear regulatory frameworks that protect user data without unfairly penalising companies for evolving threat landscapes.

As the dispute potentially moves toward arbitration and USTR review, this standoff could set new precedents for how international data breaches are regulated and how governments balance enforcement with economic cooperation. With the global digital economy continuing its rapid expansion, the coupang incident serves as a powerful reminder that data protection and cross-border investor confidence are deeply connected, and effective governance in both areas will be essential in the years ahead.